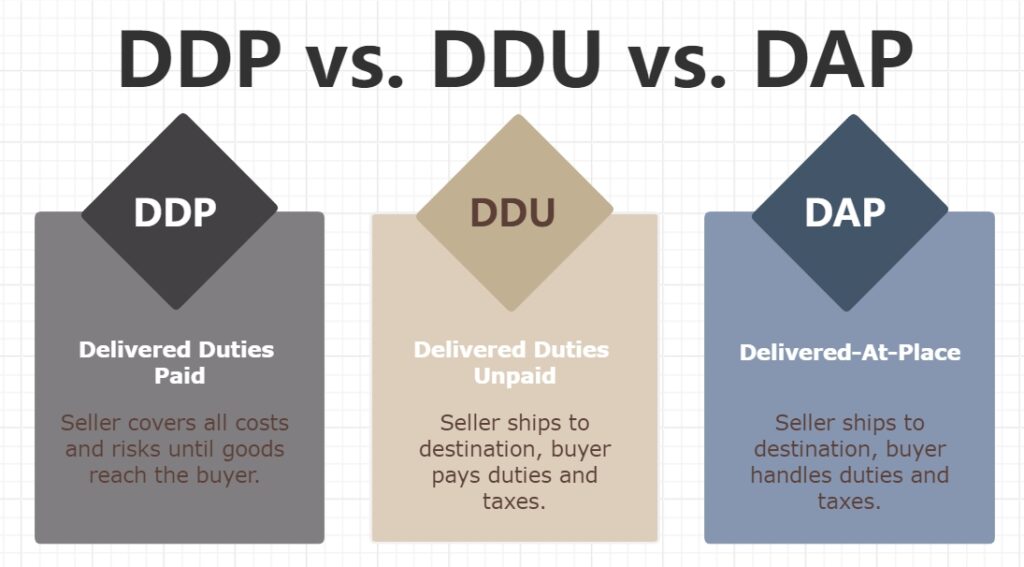

DDP, DDU, and DAP are terms you’ll often come across in international logistics. However, not everyone fully understands what these terms mean, and that can lead to some costly mistakes in the import and export process.

That’s why, in this article, we’re going to take a closer look at DDP, DDU, and DAP from multiple angles. By the end, you’ll know exactly what each term entails and how to use them to your advantage in your business.

I. What is DDP (Delivered Duty Paid)?

DDP (Delivered Duty Paid) is like the VIP treatment of shipping terms.

Here, the seller takes care of almost everything—from shipping the goods to handling all the customs duties and taxes.

Essentially, the seller ensures that the goods reach the buyer’s door without the buyer having to lift a finger (except maybe to sign the delivery receipt).

1. Seller’s Responsibilities under DDP

When a seller agrees to DDP, they’re taking on a lot of responsibility. Here’s the rundown:

- Shipping and Delivery: The seller arranges and pays for the entire shipping process, right up to the buyer’s doorstep.

- Customs Duties and Taxes: All duties, taxes, and import fees are covered by the seller.

- Customs Clearance: The seller handles the necessary customs paperwork and ensures the goods clear customs without a hitch.

2. When to Use DDP: Scenarios Where DDP is Advantageous

DDP is a great choice when:

- The buyer is inexperienced with customs processes and would rather avoid the headache.

- The seller wants to offer a seamless experience to their buyer, making the process as easy as possible.

- The buyer’s country has complex import regulations, and the seller has a better handle on them.

3. Example: How DDP Works in a Typical Transaction

Imagine you’re buying 500 wooden chairs from a manufacturer in China, and you’re located in the U.S.

If you agree on DDP, the seller will handle everything—from getting the chairs from their factory to your warehouse in New York.

They’ll deal with Chinese customs, pay all the necessary duties, and make sure the chairs are delivered to you without you having to worry about anything.

4. Pros and Cons of DDP

Pros:

- Buyer Convenience: The buyer doesn’t have to deal with customs or unexpected fees.

- Transparency: All costs are included upfront, so there are no surprises.

Cons:

- Higher Costs for the Seller: Covering all those fees can add up, which might make the goods more expensive for the buyer.

- Seller’s Risk: The seller takes on more risk, especially if they’re not familiar with the buyer’s country’s import regulations.

II. What is DDU (Delivered Duty Unpaid)?

DDU (Delivered Duty Unpaid) is like the “DIY” version of shipping.

The seller gets the goods to the buyer’s country, but from there, it’s the buyer’s job to handle the rest—customs, taxes, and all.

While DDU isn’t an official Incoterm anymore (it’s been replaced by DAP), it’s still used in practice because it gives buyers more control over the import process.

1. Seller’s and Buyer’s Responsibilities under DDU

- Seller: The seller is responsible for shipping the goods to the destination country and ensuring they arrive safely. But once they’re in the country, the seller’s job is done.

- Buyer: The buyer takes over once the goods land. They handle customs, pay the duties, and arrange for final delivery to their location.

2. Transition from DDU to DAP

DDU was officially replaced by DAP (Delivered at Place) in 2010. The main difference? Under DAP, the seller’s responsibility ends once the goods are ready for unloading, but they still don’t cover the duties and taxes—just like DDU.

3. Example: How DDU Works and Why It’s Still Used

Let’s say you’re importing electronics from Germany to your shop in Brazil. With DDU, the German seller gets the goods to the Brazilian port. But after that, it’s on you to clear customs, pay any taxes, and arrange for the goods to reach your store. Some businesses prefer DDU because it lets them handle these steps themselves, potentially saving on costs.

4. Pros and Cons of DDU

Pros:

- Lower Costs for the Seller: The seller doesn’t have to pay for duties or deal with customs, which might make their products cheaper.

- Buyer Control: The buyer can manage the import process, possibly finding ways to reduce costs.

Cons:

- Increased Responsibility for the Buyer: The buyer has to handle all the post-arrival logistics, which can be complicated and costly.

- Risk of Delays: If the buyer isn’t familiar with the customs process, they might face delays in getting their goods.

III. What is DAP (Delivered at Place)?

DAP (Delivered at Place) is the “I’ll handle most of it, but not everything” option in the world of Incoterms.

The seller gets the goods to the agreed destination, ready for unloading, but the buyer is responsible for duties, taxes, and getting the goods the rest of the way.

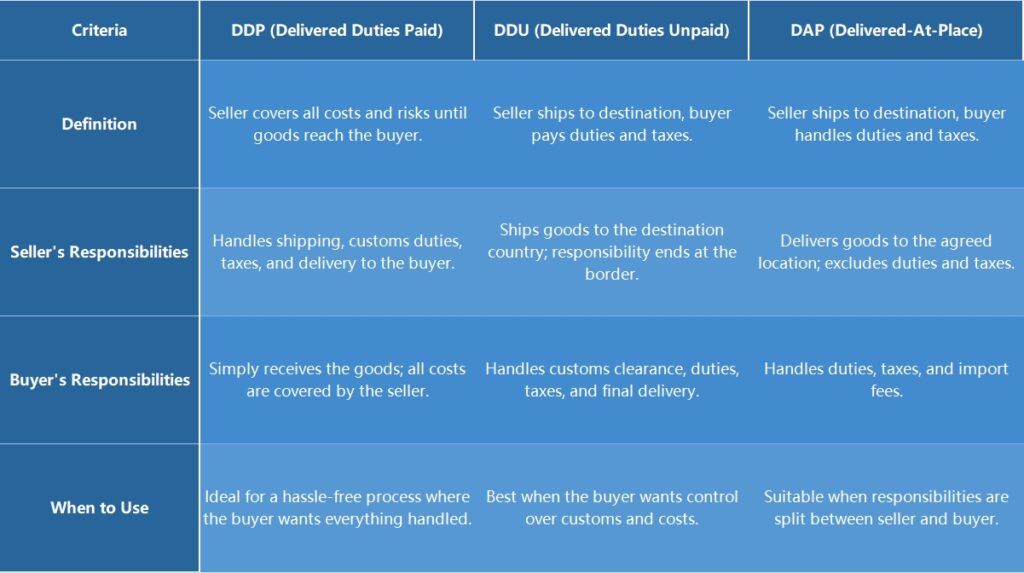

1. Key Differences Between DAP and DDP/DDU

- Compared to DDP: The seller doesn’t cover duties and taxes under DAP, making it less costly for them than DDP.

- Compared to DDU: While similar to DDU, DAP specifies that the seller must make sure the goods are ready for unloading, providing a bit more clarity and security for the buyer.

2. Example: When to Use DAP Instead of DDU

Consider you’re importing textiles from India to a warehouse in Canada.

With DAP, the Indian seller ships the textiles to your Canadian warehouse and makes sure they’re ready for unloading. You handle customs duties and taxes, but everything else is taken care of by the seller.

This can be a good option if you want more involvement in the customs process without taking on too much responsibility.

3. Pros and Cons of DAP

Pros:

- Clear Responsibility Split: The seller takes care of transportation, while the buyer handles customs—each party knows exactly what they’re responsible for.

- Cost Savings for the Seller: Since the seller doesn’t pay duties, they can offer lower prices than under DDP.

Cons:

- Buyer’s Responsibility: The buyer still has to manage customs clearance and pay any related costs.

- Potential for Confusion: If roles aren’t clearly defined, there could be misunderstandings about who handles what.

IV. How to Calculate Costs under DDP, DDU, and DAP?

Calculating costs under DDP, DDU, and DAP might seem like juggling numbers, but it’s really just about understanding who pays for what. Let’s break it down step by step.

1. Step-by-Step Guide on Calculating Costs under Each Term

- Start with the FOB Price (Free on Board):

- This is the cost of the goods at the point of origin, including loading onto the shipping vessel.

- This is the cost of the goods at the point of origin, including loading onto the shipping vessel.

- Add Shipping Costs:

- For DDP: The seller covers the shipping cost from the origin to the buyer’s door.

- For DDU and DAP: The seller covers the shipping cost up to the destination country’s port or agreed location.

- For DDP: The seller covers the shipping cost from the origin to the buyer’s door.

- Include Import Duties and Taxes:

- For DDP: The seller pays all import duties, taxes, and customs clearance fees.

- For DDU and DAP: The buyer is responsible for these costs.

- Consider Additional Fees:

- These might include insurance, handling charges, or special documentation fees. Under DDP, these are the seller’s responsibility; under DDU and DAP, they may fall on the buyer.

- These might include insurance, handling charges, or special documentation fees. Under DDP, these are the seller’s responsibility; under DDU and DAP, they may fall on the buyer.

- Final Cost Calculation:

- DDP: FOB Price + Shipping Costs + Import Duties and Taxes + Additional Fees.

- DDU: FOB Price + Shipping Costs + Additional Fees (buyer pays import duties and taxes).

- DAP: FOB Price + Shipping Costs + Additional Fees (buyer pays import duties, taxes, and customs clearance).

2. Cost Comparison Table

Here’s a simple example using real numbers to see how the costs add up differently under each Incoterm:

| Cost Component | DDP (Seller Pays) | DDU (Buyer Pays) | DAP (Buyer Pays) |

|---|---|---|---|

| FOB Price | $10,000 | $10,000 | $10,000 |

| Shipping Costs | $2,000 | $2,000 | $2,000 |

| Import Duties & Taxes | $1,500 | N/A | N/A |

| Customs Clearance Fees | $500 | N/A | N/A |

| Final Delivery Costs | $300 | N/A | N/A |

| Total Cost to Buyer | $14,300 | $12,000 + Duties & Taxes | $12,000 + Duties & Taxes |

3. Example: Calculating the Total Cost for a Shipment under Each Term

Let’s say you’re importing a shipment of electronics worth $10,000 from China to the U.S. Here’s how the costs might look under each Incoterm:

- DDP: The seller quotes you $14,300, covering everything from the FOB price to your doorstep, including all taxes and fees.

- DDU: The seller quotes you $12,000, covering the shipping to your country’s port. You’ll need to pay the import duties, taxes, and any additional fees when the goods arrive.

- DAP: Similar to DDU, but with the seller delivering the goods to a specified location (e.g., your warehouse) without covering the duties and taxes.

V. DDP vs DDU vs DAP: Which Incoterm Should You Choose?

Choosing the right Incoterm isn’t just about costs; it’s also about how much control and responsibility you want to take on. Let’s walk through what you need to consider.

1. Factors to Consider When Choosing Between DDP, DDU, and DAP

- Experience with Customs: If you’re familiar with the customs process in your country, DDU or DAP might give you more control and potentially lower costs. But if you’d rather avoid the hassle, DDP is your friend.

- Cost and Budget: DDP usually means higher upfront costs for the buyer because the seller has bundled in all the fees. If cash flow is tight, DDU or DAP might spread out the payments but be prepared for additional costs upon delivery.

- Shipping Speed: DDP might ensure a smoother, faster process since the seller handles everything, reducing the risk of delays at customs. DDU and DAP could lead to delays if there’s a holdup in customs clearance.

2. Decision-Making Framework: When to Opt for Each Incoterm

- Choose DDP if:

- You prefer a seamless, all-inclusive price.

- You want to avoid dealing with customs and potential hidden fees.

- You’re shipping to a country with complex or unpredictable customs regulations.

- Choose DDU if:

- You want more control over customs and are familiar with the process.

- You’re looking to potentially save on import duties and taxes by handling them yourself.

- You’re importing to a country where you can manage customs clearance effectively.

- Choose DAP if:

- You want a middle ground—where the seller handles most of the shipping, but you take over at the final stage.

- You need the goods delivered to a specific location but are okay with handling the customs side.

3. Impact on Business Operations and Customer Satisfaction

- DDP: Often leads to higher customer satisfaction because it’s hassle-free, but it can strain the seller’s resources.

- DDU: Can be cost-effective but may lead to customer frustration if they’re not expecting to handle customs.

- DAP: Balances responsibilities but requires clear communication between buyer and seller to avoid confusion.

VI. Common Misconceptions about DDP, DDU, and DAP

Even seasoned traders can get tripped up by some common misconceptions about these Incoterms. Let’s clear them up.

1. Addressing Typical Misunderstandings

- “DDP Means No Extra Costs for the Buyer”: While DDP does cover all duties and taxes, some buyers might still incur costs if there are issues with delivery or if the goods need additional handling.

- “DDU is Obsolete”: Although DDU has been replaced by DAP, it’s still used informally. However, understanding that DDU and DAP are almost identical is key.

- “DAP is Just a Renamed DDU”: DAP and DDU are similar, but DAP includes specific requirements about delivery being ready for unloading, offering more clarity in some situations.

2. Clarifying the Legal and Practical Implications of Each Term

- DDP: The seller bears significant legal responsibility, including ensuring all import regulations are met. This can involve a lot of paperwork and local knowledge.

- DDU: Puts more legal and financial responsibility on the buyer, which can be risky if they’re not familiar with local customs laws.

- DAP: Balances responsibilities, but it’s crucial that both parties understand where the seller’s responsibility ends—at the point of delivery, not beyond.

VII. FAQs Section

Navigating the world of international shipping can bring up a lot of questions, especially when it comes to understanding DDP, DDU, and DAP. Here are some of the most common questions—and their answers—to help clear things up.

1. What are the risks of using DDP?

Using DDP can be convenient, but it comes with its own set of risks. One major risk is overpaying on duties and taxes.

Since the seller handles all these costs upfront, they might estimate higher amounts to ensure coverage, leading to a more expensive total cost for you.

Additionally, there’s the risk of scams, especially with some less reputable sellers who might charge you for DDP but not fully handle the customs duties, leaving you with unexpected fees upon delivery.

2. Can DDU still be used despite being replaced by DAP?

While DDU is no longer an official Incoterm (replaced by DAP in 2010), it’s still widely used in practice.

Many businesses continue to use DDU because it’s familiar and the responsibilities under DDU and DAP are nearly identical.

However, if you’re entering into a formal agreement, it’s better to use the updated DAP term to avoid any legal ambiguities.

3. What’s the difference between DDU and DAP?

DDU and DAP are similar, but there’s a key difference: Under DAP, the seller’s responsibility ends once the goods are ready for unloading at the specified destination.

In contrast, DDU was a bit less clear, sometimes leading to confusion about when the seller’s responsibility actually ended. DAP is essentially a more clearly defined version of DDU.

4. Is DDP available everywhere?

DDP can technically be used for shipping to any country, but it’s not always practical.

For example, some countries have complex customs regulations that could make it risky for the seller to take on all the responsibilities involved in DDP.

Additionally, some shipping companies might not offer DDP services for certain destinations due to these complexities.

5. Can I get charged additional customs fees under DAP?

Yes, under DAP, the buyer is responsible for customs duties and taxes upon the goods’ arrival in the destination country.

If there are any additional fees, such as storage charges if customs clearance is delayed, the buyer would need to cover those costs.

6. What’s the difference between DDP and a one-stop service?

A one-stop service usually refers to a comprehensive shipping solution where the service provider handles everything from pickup to delivery, including customs clearance and duties.

DDP is similar but more specifically defined within the Incoterms, with clear-cut responsibilities between buyer and seller.

However, not all “one-stop” services will follow DDP standards exactly, so it’s important to clarify what’s included.

7. Why do some sellers refuse to ship DDP?

Some sellers avoid DDP because it involves taking on significant financial risk and responsibility. They’re responsible for all import duties, taxes, and ensuring the goods pass customs—if anything goes wrong, it’s on them. This is why some sellers might prefer to use DAP or DDU, where the buyer takes on those risks.

8. How do I know if I’m being scammed with DDP?

A common DDP scam involves sellers who promise to cover all duties and taxes but then fail to do so, leaving the buyer with unexpected fees.

To avoid this, work with reputable sellers and always get a detailed breakdown of what’s included in the DDP agreement. Check online reviews and forums to see if others have had issues with the seller before proceeding.

Conclusion

Choosing the right Incoterm—whether it’s DDP, DDU, or DAP—can be the difference between a smooth, predictable shipping process and one filled with unexpected costs and complications. The key is understanding not just what these terms mean, but how they fit into your business strategy.

Need help navigating these options? Don’t worry—this is where we step in. We can guide you through the complexities, ensuring you make the best choice for your specific needs. Whether you’re aiming for convenience with DDP, more control with DDU, or a balanced approach with DAP, we’ve got the expertise to help you get it right.

Let’s simplify your shipping process together. Reach out to us today, and let’s make your next international shipment the easiest one yet.

Relative Articles: